Our client

This US-based fintech company offers payment processing and point-of-sale (POS) solutions, payroll, insurance coverage, gift and reward cards, and other financial tools for small businesses. This success story falls under Prolifics’ Intelligent Process Innovation and Digital Automation & AI offerings. We acquired this client through our Intelligent Automation Workshop.

Challenge

Our client targets small businesses with two main offerings – payment processing / point-of-sale (POS) solutions and payroll processing. For both offerings our client provides equipment and training, as well as a line of credit. Our client ensures that a small business is worth the client’s investment of equipment, time and financial risk through a rigorous onboarding and underwriting process.

Unfortunately, much of this onboarding and underwriting involves intensive manual steps and procedures. The small businesses are sending in applications through our client’s website or as document attachments in emails. Our client needs personnel behind the scenes just to download application packages to place into their homegrown workflow system. Client “on-boarders” processing the applications have been taking a long time to go through the forms, which are often hard to read and are missing pages, which then requires connecting back to the business. The client currently has three on-boarders, who are only able to process about 260 applications in a month. This doesn’t include the time needed for underwriting, which is handled by different personnel. In addition, the client had no real processes or procedure for storing application information in a database – it went in as a “blob.”

Our client is looking to implement an aggressive growth plan, with a target of 1,600 applications a month. However, with the inability to scale the existing staff, this would mean adding about 19 new people. The client looked to us for technological help.

Action

We conducted our Intelligent Automation Workshop with our client. The Workshop pairs client personnel with our automation experts to create a strategy, roadmap and solution that leverages intelligent automation. It will provide continuous process improvement that maps to the client’s business outcomes. Workshop activities include interactive sessions to refine and score opportunities for improvement, validate business drivers and develop an action plan for next steps.

Workshop goals include:

- Understanding strategic objectives and business outcomes

- Leveraging Prolifics methodology to map business outcomes to key performance indicators (KPIs)

- Identifying insights for opportunities for improvement that directly improve KPIs

- Building and implementing a business case for improvement through leveraging different automation capabilities

Workshop take-aways include:

- Implementation roadmap

- Process transformation outlined through Prolifics Business Benefit graphs

- Assessment of business drivers, pain points, objectives, and benefits from use case information

Result:

The client found that its investment in terms of time dedicated to the workshop was a success and that the approach led to concrete conclusions. Prolifics VP Salem Hadim heads both our Intelligent Process Innovation and Digital Automation & AI offerings. “Our client’s CEO had the key mandate to grow the organization without adding operational costs,” said Hadim. “In the workshop we quickly identified the use case where automation and process innovation will help our client. We clearly established the pain points, the improvement opportunities, and – most importantly – we gave him an ROI that meets his mandates. The CEO was tremendously happy with the workshop and its take aways.”

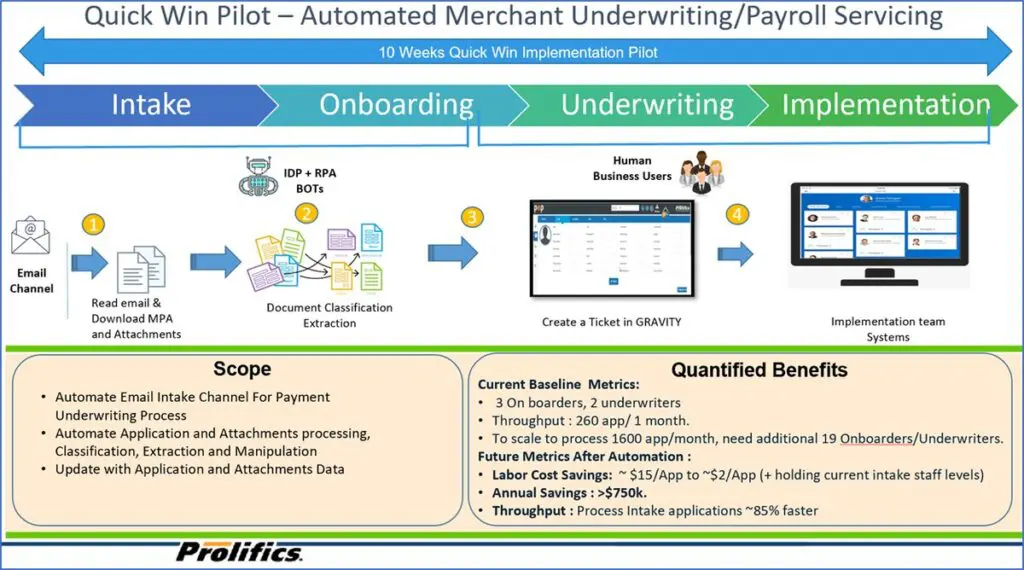

The improvement opportunities derived from the workshop included a “quick win” pilot program that:

- Begins with using Intelligent Document Processing (IDP). IDP is a process that leverages artificial intelligence (AI) to read text and extract the needed information. With infused AI, IDP reads the applications (whether through the website or email attachments) just as a human is able to read them – only faster, cheaper and with a much lower error rate.

- Once IDP captures the information from the submitted application, robotic process automation (RPA or “bots”) is used to complete all the manual work that the on-boarders had to deal with. With bots doing much of the work, the underwriters got all the information they needed neatly prepared and packaged for them.

- We identified and gave the client options on ways to store the application documents, and how to search those documents for audit and compliance purposes.

We’ve estimated that this quick win program will save them more than $750,000 annually, with a much faster application throughput rate. Hadim notes, though, that a quick win program decision, especially when implementing automation, should not be made in a vacuum – it’s part of an overall, holistic approach that differentiates Prolifics from competitors.

“When you automate, it must be the correct adoption of automation,” said Hadim. “You must make sure you look at your process end-to-end, and then use automation the right way. It’s combining a tactical approach to make a quick win, but also looking at things strategically so that the quick win is not thrown away. Many vendors will automate something that’s not needed – the company should be changing and innovating the larger processes. Automation must be part of your roadmap, part of your enterprise-wide adoption.”

As a fintech company, our client is part of the larger banking, financial services and insurance (BFSI) industry that Prolifics serves on a regular basis. Hadim said, “Recently we’ve implemented bots at a mortgage company to help them scale; implemented application automation at a financial clearing house; and configured the entire infrastructure automation for a credit card processor’s new data center. BFSI companies are ripe for process innovation and RPA.”

More on our Intelligent Process Innovation and Digital Automation & AI offerings

Prolifics Intelligent Process Innovation looks at an organization’s processes from both the top down and the bottom up. We use this holistic view to identify opportunities for new competitive advantages and outcomes, including reduced operational costs, higher levels of employee productivity and customer experience, and greatly improved compliance.

With Digital Automation & AI, our focus is utilizing robotic process automation (RPA / bots), artificial intelligence (AI), conversational AI, generative AI and data science to automate and scale your operation’s low-value, manual and repetitive tasks. These processes are now more productive in terms of time, cost and quality, and your human knowledge workers can now handle other, high-value innovative projects.

About Prolifics

At Prolifics, the work we do with our clients matters. Whether it’s literally keeping the lights on for thousands of families, improving access to medical care, helping prevent worldwide fraud or protecting the integrity and speed of supply chains, innovation and automation are significant parts of our culture. While our competitors are throwing more bodies at a project, we are applying automation to manage costs, reduce errors and deliver your results faster.

Let’s accelerate your transformation journeys throughout the digital environment – Data & AI, Integration & Applications, Business Automation, DevXOps, Test Automation, and Cybersecurity. We treat our digital deliverables like a customized product – using agile practices to deliver immediate and ongoing increases in value.