-Gunjan Goel

A quiet yet transformative shift is unfolding in the U.S. payments landscape. In March 2025, the White House announced a sweeping federal mandate for ACH payments 2025: by the end of the fiscal year, nearly all federal payments, including tax refunds, must transition from paper checks to electronic disbursement, primarily via the Automated Clearing House (ACH) network.

While this policy promises enhanced efficiency, reduced costs, and faster processing, it also sets the stage for a substantial spike in ACH payment volume. For many financial institutions, this shift introduces urgent challenges around operational capacity, reducing fraud in electronic payments, and compliance readiness.

Delivering seamless, secure, and scalable ACH payment solutions is non-negotiable in the ever-evolving Banking and Financial Services (BFS) sector. Among the various electronic payment rails, ACH payments stand out for their reliability, affordability, and ubiquity across both business and consumer transactions.

This paper outlines the expanding role of ACH payments, the growing pains associated with increased adoption, and how Prolifics is equipping financial institutions with the visibility, control, and agility needed to manage this transition and thrive in the new payment era.

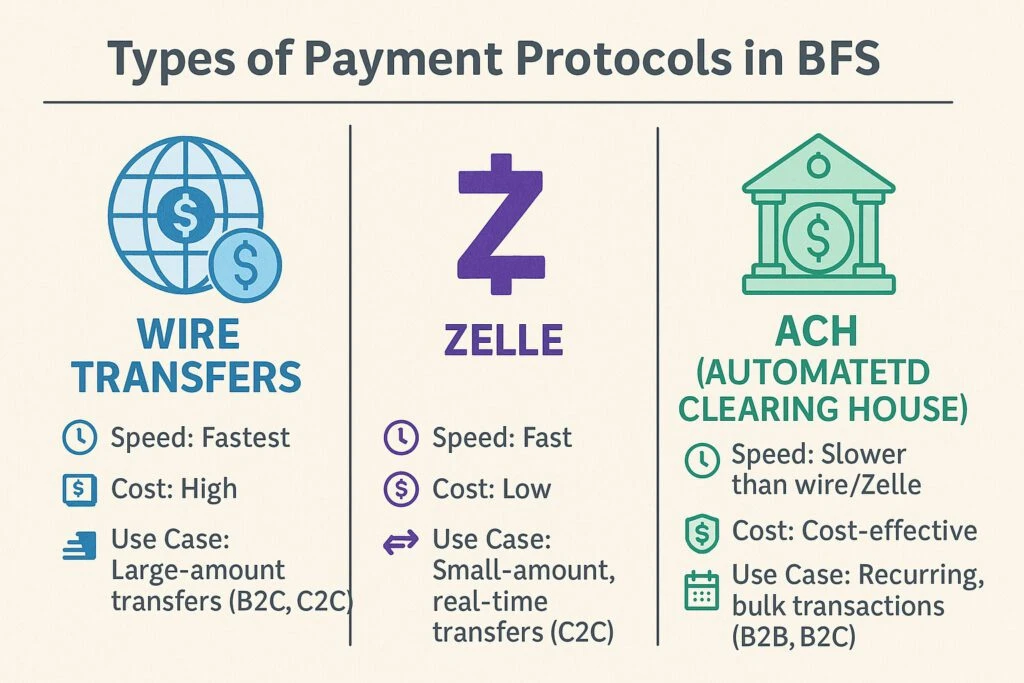

Types of Payment Protocols in BFS

Financial institutions use various protocols to transfer funds between accounts. These differ in terms of speed, cost, and suitability:

- Wire Transfers

- Speed: Fastest

- Cost: High

- Use Case: Large-amount transfers (B2C, C2C)

- Zelle

- Speed: Fast

- Cost: Low

- Use Case: Small-amount, real-time transfers (C2C)

- ACH (Automated Clearing House)

- Speed: Slower than wire/Zelle

- Cost: Cost-effective

- Use Case: Recurring, bulk transactions (B2B, B2C)

What Are ACH Payments?

ACH payments electronically move funds between U.S.-based financial institutions using a central clearing house while masking actual account numbers for security. These transfers, long replacing paper checks, are pivotal to operations such as:

- Direct deposits (e.g., payroll)

- Recurring payments (e.g., mortgages, utilities)

- Direct bill payments (e.g., subscriptions)

Although the FedNow service is gradually being introduced, ACH payments remain a cornerstone of the U.S. banking system. They are extensively used for direct deposits, recurring payments, and bill payments, with a per-transaction limit of $1 million. Given this scale and purpose, batch processing in ACH payments, predictability, timeliness, and operational robustness are essential.

However, these very attributes contribute to a complex web of interconnected transactions—often described as a voluminous “spaghetti” of exchanges. In 2024 alone, the ACH network processed an average of 78.9 million transactions per day, moving up to $3.23 trillion daily, culminating in a yearly total of 33.6 billion transactions and an approximate value of $86.2 trillion.

Key Challenges in the ACH Payment Process

The ACH system thrives on predictability, robustness, and trust, attributes supported by decades of operational excellence. However, its complexity introduces several challenges:

- Profile Management: Banks maintain intricate profiles for partner institutions and payment patterns.

- SLA Compliance: Transactions are processed in batches using EDI files governed by NACHA rules, demanding strict adherence to timelines.

- Error Handling: Detecting and resolving faulty files or failed transmissions without manual intervention is essential.

- Operational Risk: Reputational harm, regulatory penalties, and loss of customer trust are constant concerns.

- Lack of Visibility: Institutions often struggle with end-to-end traceability of individual transactions.

- Scalability and Insights: With growing volumes, banks need AI in payment processing to optimize operations and decision-making.

Benefits of ACH Payments

ACH (Automated Clearing House) payments have become a foundational pillar in banking digital transformation due to their reliability, efficiency, and cost-effectiveness. Below are the key benefits that make ACH payments a preferred choice for both financial institutions and businesses:

- Cost Efficiency

Compared to wire transfers or paper checks, ACH transactions are significantly less expensive. This makes them ideal for high-volume, recurring payments such as payroll, vendor payments, and customer refunds. - Security and Compliance

ACH transactions are processed through a regulated network governed by NACHA rules, ensuring compliance and reducing fraud in electronic payments. Sensitive account details are kept confidential, adding an extra layer of protection for secure digital banking solutions. - Convenience and Automation

Payment automation in banking can be achieved through ACH, which is ideal for routine use cases like direct deposits or subscription billing. This reduces administrative overhead, eliminates manual processing errors, and enhances operational efficiency. - Predictability and Reliability

ACH follows a structured batch processing schedule, making it easier for organizations to predict cash flows and manage liquidity. This consistency supports better financial planning and reconciliation. - Scalability

Whether handling a few dozen transactions or millions per day, the ACH network is built for scale. In 2024, it processed 33.6 billion transactions totaling $86.2 trillion, proving its robust infrastructure. - Environmental Sustainability

By eliminating the need for paper checks, envelopes, and physical transport, ACH supports sustainability goals and reduces the carbon footprint of financial operations.

Prolifics’ Point of View: Solving ACH Visibility and Performance Challenges

At Prolifics, we recognize the critical role ACH payments play in modern banking and the necessity of having clear, actionable insight into every transaction. Our ACH visibility solution enables:

- Auditable, Real-Time Rules Enforcement

- Visual interface to reprocess, redeliver, and handle bad files dynamically.

- Transaction-Level Traceability

- Interactive dashboards to monitor and zoom into each transaction’s status, stage, and confirmation.

- Actionable Metrics and Insights

- Intelligent reporting to visualize flow health, identify bottlenecks, and guide strategic improvements.

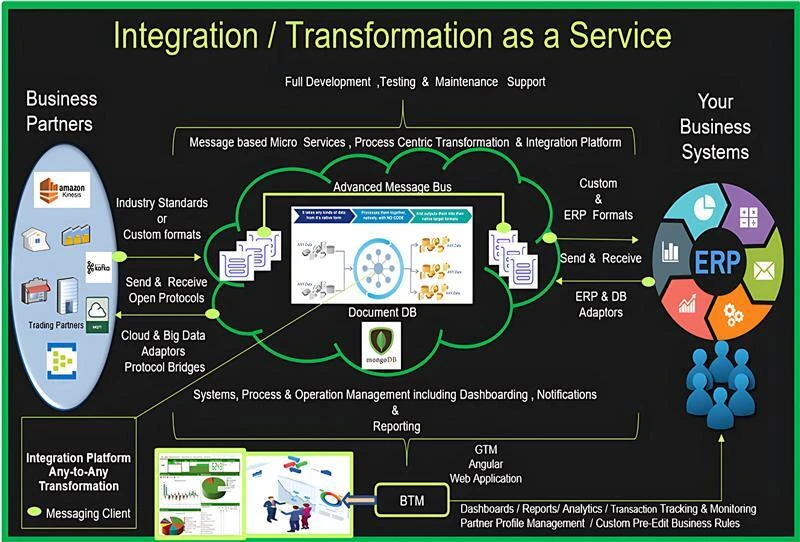

Sample Logical System Diagram

About the Author

Gunjan Goel is an innovator, change agent, and leader in the BFS sector with deep expertise in process optimization, analytics, and customer experience. As Head of BFS at Prolifics, he leverages digital transformation tools to drive efficiency, revenue growth, and client trust. With nearly 25 years of consulting experience across North America, Europe, and India, Gunjan consistently delivers transformative programs for forward-thinking financial institutions.

📩 Contact: gunjan.goel@prolifics.com

About Prolifics

At Prolifics, innovation and automation aren’t just trends—they’re part of our DNA. Whether we’re modernizing payments in banking, enabling real-time fraud prevention, or improving patient care, our teams apply the latest in technology to deliver faster, better, and cost-effective outcomes. Our capabilities span:

Visit prolifics.com to learn how we can accelerate your digital banking transformation.

References

Download the blog in PDF format: Download PDF