The banking and finance industry is no stranger to innovation. From ATMs to digital wallets, every technological leap has reshaped how institutions interact with customers and manage risk. Today, the next era of transformation is here—Artificial Intelligence (AI), with agentic AI in banking emerging as a defining shift in the industry.

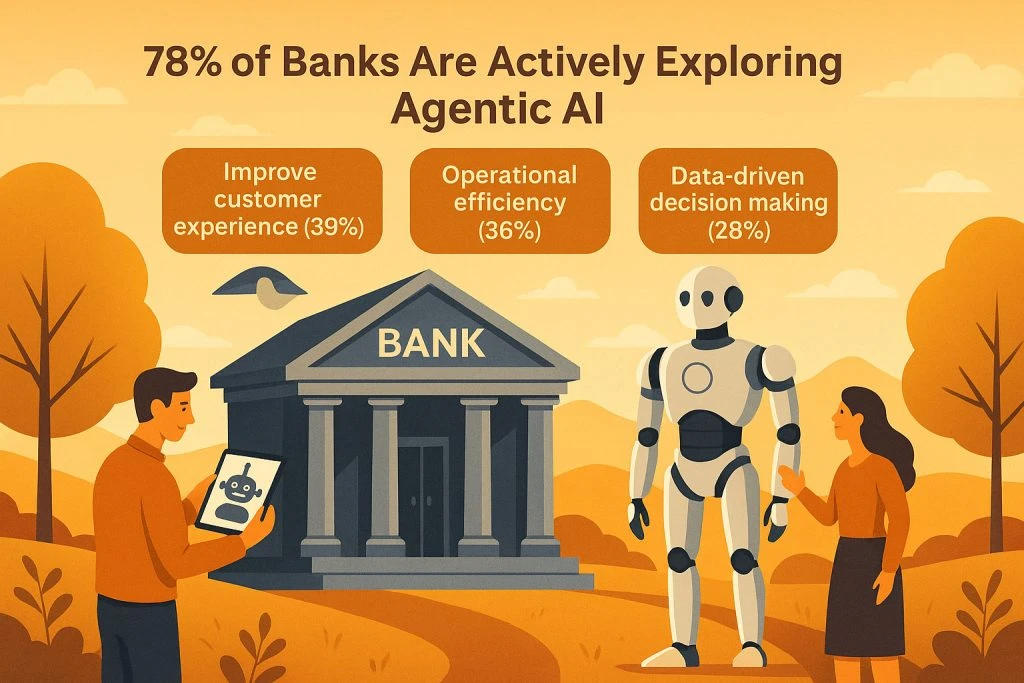

IDC’s latest report on Agentic AI: Driving a New Wave of Banking Transformation mentioned that 78% of Banks are actively exploring IBM agentic AI, and banks are using AI in banking transformation initiatives to improve customer experience (39%), operational efficiency (36%), and data-driven decision making (28%).

As financial institutions move from experimentation to tangible outcomes, IBM’s latest automation in banking capabilities are redefining what’s possible in banking, empowering institutions to innovate faster, operate smarter, and build resilient systems for the future.

From Experimentation to Impact: AI’s Maturity Moment in Banking

The early wave of AI in finance was marked by curiosity and pilot projects. Banks experimented with chatbots, credit risk models, and process automation, exploring the boundaries of machine learning. Now, the tide has shifted. AI has evolved from exploration to execution, where measurable business impact takes precedence over experimentation accelerating AI in banking transformation.

IBM’s hybrid cloud and automation-driven approach to AI enable banks to scale innovation while managing risk. The result? Financial institutions can now deploy AI solutions that optimize operations, improve compliance, and drive revenue, not just in labs, but across the enterprise, paving the future of banking with AI.

Solving Real-World Challenges: How AI Transforms Financial Operations

AI is no longer confined to the data science department. Its influence now permeates every corner of the financial services ecosystem, from risk oversight to customer engagement. Let’s explore how IBM agentic AI technologies are solving some of the industry’s most pressing challenges.

1. Overcoming Skill Shortages with Accelerated Code Development

With the rise of agentic AI in banking, coding bottlenecks are becoming a thing of the past. IBM’s AI-powered development tools empower engineers to automate code generation, refactor legacy systems, and build new applications faster. This not only bridges the skills gap but also frees up technical teams to focus on innovation rather than routine maintenance.

2. Reducing Operational Downtime

AI’s predictive capabilities are being leveraged to detect anomalies in IT systems before they cause disruptions. Through AIOps and intelligent monitoring, IBM enables banks to minimize downtime, maintain uptime for mission-critical services, and deliver seamless digital banking experiences 24/7.

3. Enhancing Risk Management and Compliance

Regulatory compliance in banking is complex, but AI can make it manageable. IBM’s AI models use natural language processing to interpret new regulations, analyze transactions for suspicious patterns, and ensure real-time compliance. This proactive approach reduces the risk of fines and reputational damage.

4. Driving Digital Transformation

AI is the driving force behind modern, data-driven banking ecosystems. By integrating AI across hybrid cloud platforms, IBM helps financial institutions transition from traditional operations to intelligent systems that learn, adapt, and evolve. These AI-powered transformations enable faster decision-making and improved business agility.

5. Enhancing Customer Experience

In the experience-driven banking era, personalization is power. IBM’s AI solutions enable banks to deliver hyper-personalized experiences, predicting customer needs before they arise. From chatbots that handle inquiries instantly to recommendation engines that tailor financial products, AI humanizes banking interactions at scale.

6. Accelerating Application Modernization

Legacy systems are often the biggest barrier to innovation. IBM’s application modernization frameworks, supported by AI and automation, allow banks to modernize core systems without disrupting ongoing operations. This transformation improves agility, reduces costs, and enables integration with emerging fintech ecosystems.

7. Reshaping Onboarding and Employee Experience

AI isn’t just transforming customer journeys, it’s reshaping employee workflows too. From AI-driven onboarding assistants that accelerate new employee integration to digital learning systems that personalize upskilling, IBM’s AI makes banking a smarter place to work.

8. Boosting Efficiency Across Business Processes

With automation powered by IBM Watson and AI Operations, manual workflows can be digitized, monitored, and optimized. AI streamlines processes such as loan approvals, fraud detection, and data reconciliation, drastically improving turnaround times and accuracy.

IBM: A Century of Financial Innovation and Trust

IBM’s legacy in banking stretches back more than a century. Today, over 90 of the world’s largest banks trust IBM to drive transformation across core operations, security, and innovation. That deep partnership with financial institutions forms the foundation for the agentic AI revolution.

Through IBM Consulting, banks gain access to advisory, strategy, and implementation services tailored to the demands of modern finance. These capabilities span:

- Core banking modernization

- Payments transformation

- ISV-enabled banking

- Intelligent business operations

- Risk management and regulatory compliance

- Cybersecurity and fraud detection

IBM’s hybrid approach ensures banks can seamlessly integrate AI into their ecosystems, whether on-premises, in private clouds, or across multiple cloud providers.

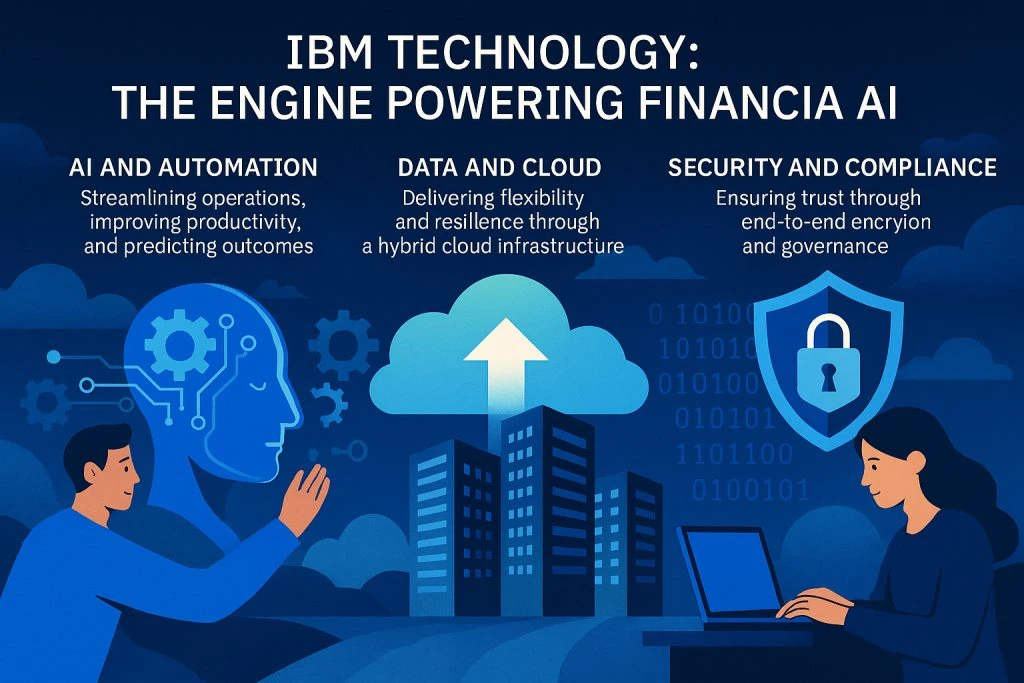

IBM Technology: The Engine Powering Financial AI

Behind every AI success story in finance lies IBM’s cutting-edge technology portfolio. From data management and analytics to security and cloud computing, IBM provides the tools institutions need to modernize, innovate, and compete.

- AI and Automation: Streamlining operations, improving productivity, and predicting outcomes.

- Data and Cloud: Delivering flexibility and resilience through a hybrid cloud infrastructure.

- Security and Compliance: Ensuring trust through end-to-end encryption and governance.

These technologies empower financial organizations to build adaptive, intelligent architectures, ones that can process billions of data points in real time, spot opportunities, and manage risks proactively.

Real-World Use Cases: AI in Action Across Banking & Finance

AI-Powered Fraud Detection

Banks are leveraging IBM’s AI algorithms to analyze billions of transactions daily, identifying anomalies that traditional systems might miss. This results in faster fraud detection and fewer false positives, protecting both customers and profits.

Predictive Risk Management

AI models simulate various market conditions, helping financial institutions anticipate risks before they manifest. Through data-driven insights, banks can safeguard investments and maintain portfolio stability even during volatile times.

AI in Payments and Customer Service

AI chatbots and virtual assistants are transforming customer interactions, offering instant responses and personalized support. Meanwhile, AI in payments enables smarter routing, reduced transaction failures, and improved cash flow management.

Customer Stories: AI Success in the Financial Sector

- A Global Bank’s Compliance Revolution:

Leveraging IBM Watson, a leading global bank automated 70% of its compliance tasks, reducing regulatory review times from weeks to hours. - A Regional Lender’s Digital Acceleration:

Partnering with IBM Consulting, a mid-sized lender modernized its core systems with AI-driven automation, improving loan approval times by 45% and boosting customer satisfaction scores. - A Financial Services Leader’s Fraud Defense:

Using IBM’s hybrid cloud and AI-based monitoring, this firm achieved a 60% reduction in fraudulent activity while cutting manual investigation hours in half.

Conclusion: The Power of Partnership — IBM + Prolifics

As the financial industry evolves, transformation demands both innovation and expertise. That’s where the partnership between IBM and Prolifics stands apart.

Prolifics combines its deep domain experience in digital transformation, data, AI, and automation with IBM’s powerful AI and hybrid cloud technologies to deliver end-to-end modernization solutions for banks and financial institutions. Together, they enable organizations to accelerate AI adoption, enhance compliance, and shape the future of intelligent banking.

The future of banking isn’t just digital, it’s intelligent, resilient, and agentic. And with IBM and Prolifics leading the charge, the next chapter of financial innovation is already being written.

Join Prolifics and IBM: Unlocking the Future of Banking & Finance with Agentic AI

Prolifics and IBM invite you to attend Unlocking the Future of Banking & Finance with Agentic AI, an exclusive session showcasing real-world banking use cases, IBM’s latest AI capabilities, and actionable insights for financial innovation and resilience.

This event offers a firsthand look at how IBM’s agentic AI, powered by automation and hybrid cloud, is redefining the industry’s digital core, with live demonstrations, customer stories, and expert discussions on the future of financial transformation.