Three Reasons a Digital Loan Coworker Makes Sense

If you’re a lender, or work in IT for a lending institution, you’ve likely felt the ripple effects of the “New Normal” in very specific ways. Interest rates are at historic lows, but what does that really mean for mortgage demand? The Paycheck Protection Program (PPP) arrived like a hurricane—so what’s next? And after so much disruption, what should you be doing to support your employees?

Believe it or not, a digital loan coworker can help with each of these challenges. By integrating digital workers for loan processing into your operations, you can streamline tasks, scale capacity, and improve accuracy without adding unnecessary strain to your team.

1) How a Digital Loan Coworker Helps Manage Mortgage Volume

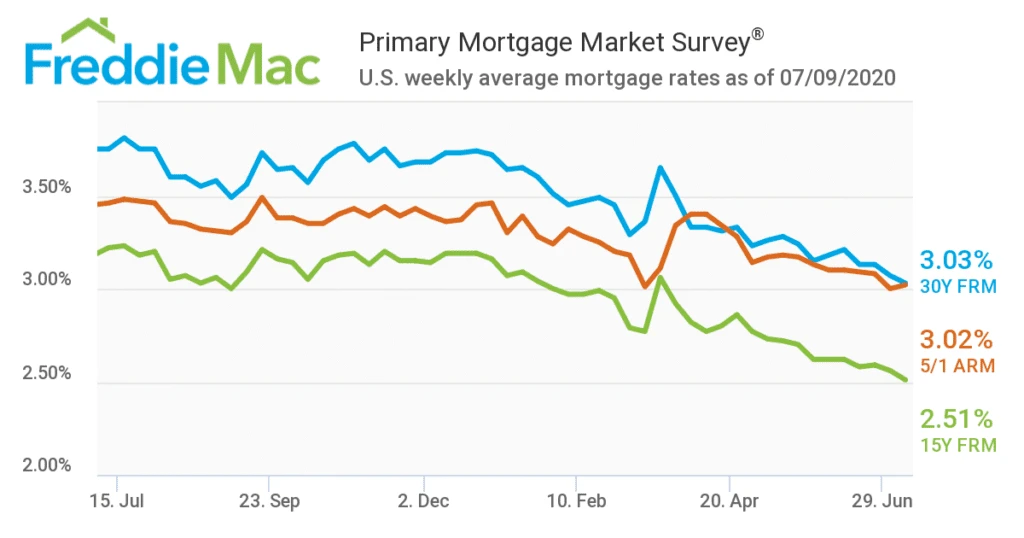

The Federal Home Loan Mortgage Corporation (Freddie Mac) recently reported record-low mortgage rates, with the 30-year fixed-rate mortgage dropping 72 basis points in a year to just 3.03%. While long-term demand remains uncertain, refinancing activity has surged. Freddie Mac’s research shows single-family first lien refinances reached nearly $400 billion—double the previous year’s volume.

Managing workforce size amid fluctuating demand is challenging.

- Hire too many staff, and you risk layoffs.

- Hire too few, and your team becomes overwhelmed.

- Add remote work, and the complexity multiplies.

Here’s where mortgage automation solutions make a difference. A digital loan coworker can scale up or down instantly based on loan volume—no hiring or training required. This approach supports mortgage scalability, enabling you to handle refinancing surges through automated mortgage processing efficiently.

Key benefits include:

- Quick response to market fluctuations

- Cost-effective scaling without added staff

- Improved speed and accuracy in loan processing

2) The Customer Service Example – PPP Loan Forgiveness

Remember the chaos during the initial PPP loan rush—full lobbies, endless phone calls, and piles of paperwork? Many lenders successfully helped businesses secure funding, but the next challenge—PPP loan forgiveness—brought similar pressure.

The SBA released a simplified, borrower-friendly PPP forgiveness application and a three-page “EZ” version for certain cases. Despite these tools, businesses still needed fast results, creating massive processing demands.

A digital loan coworker can streamline this process by:

- Reading and sorting incoming emails

- Collecting and verifying loan applications

- Performing data consistency checks

- Routing information automatically to the next step

This intelligent process automation for lenders speeds up forgiveness approvals, improves service quality, and prevents the bottlenecks seen during the initial rollout. It’s also the foundation for scalable PPP loan forgiveness automation, freeing your team to focus on meaningful customer interactions.

3) The Free Up Your Employees Example – Across All Loan Types

Every lending operation handles repetitive, manual tasks—matching data, re-keying information, and navigating disconnected systems. These tasks are time-consuming, error-prone, and lower morale, especially in remote settings.

A digital loan coworker never tires of repetitive work. It runs 24/7, maintains near-zero error rates, and bridges data silos across systems. By leveraging robotic process automation (RPA) in banking, you can:

- Reduce human error in loan processing

- Save time on manual data entry

- Boost employee satisfaction through more engaging work

This isn’t about replacing people—it’s about empowering them. With automation handling routine work, employees can focus on tasks that require human judgment and customer empathy.

Top advantages of digital coworkers in lending:

- Improved employee engagement and retention

- Higher accuracy and faster turnaround times

- Lower operational costs

Partner with Experts Who Understand Lending Automation

The “New Normal” demands efficiency, scalability, and agility. You must adapt quickly to changing market conditions while minimizing costs.

Prolifics offers digital workers for loan processing—like Archie, your own digital loan coworker—designed to deliver fast, accurate, and seamless results. Our expertise covers:

- Automation for mortgage refinancing and PPP loans

- Scalable solutions for fluctuating lending demand

- End-to-end digital transformation for financial institutions

Whether you want to explore how a digital coworker improves mortgage processing or implement PPP loan forgiveness automation, we can help you transform operations and prepare for long-term success.

Ready to get started?

Email solutions@prolifics.com to discover how automation can future-proof your lending business.