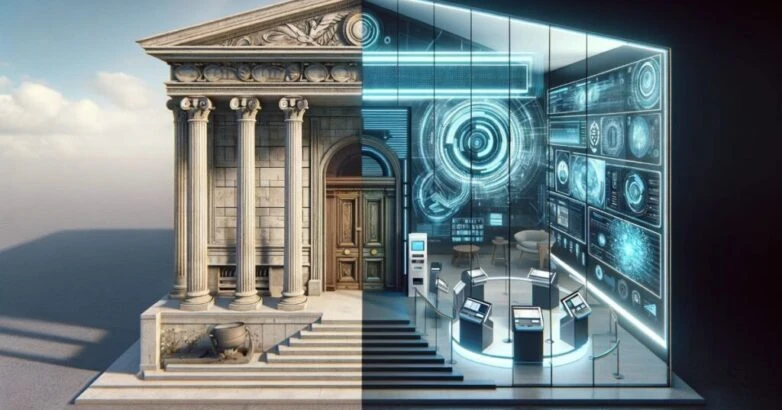

Challenge – “We Couldn’t Modernize the Bank”

Our client, a leading financial institution, faced a major challenge: data chaos. With more than 25 terabytes of data spread across 1,600 systems, the bank struggled with poor data quality, unclear data flows, and siloed systems that limited visibility.

Legacy infrastructure made it impossible to automate or optimize even the simplest transactions. For instance, when a new client opened an account, the onboarding to the digital platform could not occur for an hour while waiting for batch processes—often leading to customer abandonment and lost business opportunities.

Repeated modernization initiatives failed to deliver results because data lies at the heart of value delivery, and fragmented, unreliable data blocked all progress. Leadership recognized that meaningful digital transformation was impossible without solving the data issue first. Their strategic vision:

“Become the best digital bank in the industry through a transactional Master Data Management (MDM) platform for client data.”

Action – An Ongoing Journey

The bank embarked on a multi-year modernization journey to build a Master Client Profile (MCP) as its MDM platform—essentially a full transactional customer master hub. They selected the IBM MDM Advanced Edition suite but required specialized development expertise. IBM recommended Prolifics as a trusted implementation partner.

Phase 1: MDM Architecture Consulting and Implementation

The greatest challenge was building the “new world” without disrupting the old one. The transition strategy was deliberately iterative—start small, scale steadily, and maintain business continuity throughout.

Prolifics and the bank jointly developed a transition roadmap that balanced sustaining existing customers, enabling future growth, and delivering incremental value.

Prolifics began with the commercial banking division, achieving immediate results—client uniqueness improved from 23% to 95%. The team then integrated multiple CRM platforms, including SAP. Initially, many believed connecting SAP under IBM’s MDM was impossible—but the team successfully proved otherwise.

Phase 2: Expansion and Integration

Building on early success, Phase 2 focused on broadening the MDM ecosystem to include additional financial and operational systems.

Prolifics integrated Salesforce with MDM to trigger automated workflows whenever client profiles were added or updated, leveraging Business Process Management(BPM) capabilities. The BPM workflows were customized for data owners, enabling smooth data flow across departments.

Further, MDM was integrated with the core banking system for retail customers, and synchronized with the Common Reporting Standard (CRS) system’s UI and database. Prolifics also developed nine additional services to retrieve and share retail customer data from MDM to SAP and other systems.

Ongoing: Managed Services and Continuous Improvement

Following the successful implementation, the client transitioned to a managed services model. Prolifics continues to support the bank by augmenting teams responsible for maintaining and enhancing the MDM solution.

This model ensures continuous optimization, seamless integration of new data sources, and the flexibility to evolve with changing business and regulatory demands.

Result – A Foundation for a Digital Bank You Can’t Do Without

The MDM platform has become the digital backbone of the bank’s transformation journey. With clean, centralized, and trusted client data, every business line now benefits from improved efficiency, consistency, and insight-driven operations.

Key Benefits:

- Consistency and Access: Previously, client information had to be manually entered in multiple systems—now, a single profile automatically populates across all connected platforms, eliminating rework and duplication.

- Efficiency: The bank reduced 7,000+ duplicate company profiles, significantly streamlining operations.

- Trusted Data: Nearly 100% of free-text entries were eliminated, creating structured data models ideal for AI-driven analytics and smarter decision-making.

The MDM foundation is truly “the gift that keeps on giving.” As integration deepens, every department across the bank gains access to a single, trusted source of truth—enhancing productivity, compliance, and customer experience.

Technology – IBM MDM Advanced Edition

IBM MDM Advanced Edition supports multiple implementation styles and domains, offering a comprehensive suite of capabilities to meet demanding enterprise requirements.

Key features include:

- Highly accurate probabilistic matching and search

- Support for multiple implementation styles

- Pre-built, extensible data models and business services

- Ability to handle large transaction loads with high availability

- Data quality improvement via governance workflows and policies

- Robust security model for managing user access and actions

About Prolifics

At Prolifics, the work we do with our clients truly matters. Whether it’s keeping the lights on for thousands of families, improving access to medical care, preventing global fraud, or securing supply chains, innovation and automation are core to our DNA.

While others add manpower, we apply automation to manage costs, reduce errors, and accelerate delivery. We fast-track your digital transformation journey through our deep expertise in:

- Data & AI

- Integration & Applications

- Business Automation

- DevXOps and Test Automation

We approach every digital deliverable like a product—applying agile methodologies to deliver continuous, measurable value.

Learn more about our Banking & Finance expertise and Data & AI solutions.