The payments industry is on the cusp of a transformation as Artificial Intelligence takes a bold new leap, from predictive and reactive models to agentic AI, where intelligent payment systems can autonomously act on behalf of users. In an ecosystem where speed, security, compliance, and customer experience are paramount, agentic AI in payments is emerging as the game-changer.

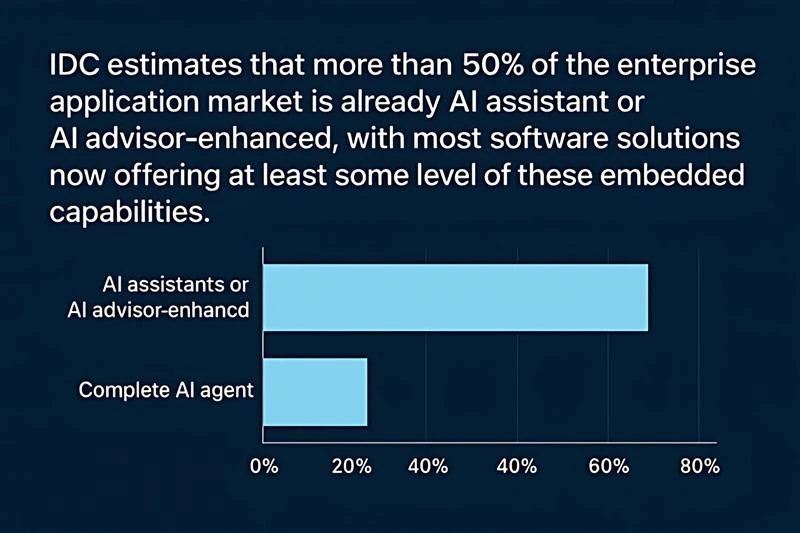

IDC estimates that more than 50% of the enterprise application market is already AI-powered payment solutions through assistants or advisors, with most software now embedding these capabilities. Beyond this, approximately 20% of the market is further supplementing their applications with complete AI agents in banking and payments.

While traditional AI supports automation and analytics, agentic AI for financial services takes ownership of tasks, learns dynamically from context, and executes with autonomy. These capabilities open the door to frictionless, personalized, and secure autonomous payments technology at scale. For enterprises, this evolution is not just a technical upgrade, it’s a strategic opportunity to outpace competitors and reimagine financial workflows from the ground up.

Why Agentic AI Is a Game-Changer for Payments

Today’s payments ecosystem is fragmented, bogged down by legacy systems, manual reconciliations, compliance checks, and inefficiencies. Financial institutions and fintech providers are looking for AI-driven payment automation that doesn’t just inform decision-making but actually makes decisions in real time. This shift toward end-to-end payment automation signals the future of payments with AI.

Promising Solutions Already Taking Shape

Here’s how agentic AI is disrupting payment paradigms with tangible innovations:

1. Single-Use Virtual Cards

Virtual card payment security is strengthened as agentic AI autonomously generates one-time-use numbers. These single-use cards limit fraud exposure and eliminate the risk of stolen credentials being reused. AI agents in banking and payments manage card creation, usage monitoring, and auto-deactivation, removing human friction.

2. Programmable Money & Smart Contracts

Imagine payments that self-execute based on conditions encoded in AI-enabled smart contracts. Agentic AI enables this by managing AI-powered digital wallets, authenticating preconditions, and triggering transactions automatically. This is powerful for subscription models, supplier payments, or cross-border settlements—examples of programmable money platforms redefining digital finance.

3. Automated Reconciliation

Say goodbye to manually matching invoices with payments. Automated payment reconciliation allows AI-driven treasury management to reconcile transactions in real time against invoices, POs, or contracts. This reduces errors, accelerates month-end close, and frees finance teams for higher-value activities—the benefits of AI-driven reconciliation for finance teams are clear.

4. Dynamic Payment Settlements

Dynamic settlement optimization is made possible by AI agents that evaluate currency fluctuations, liquidity, and market conditions. For treasury teams managing multi-currency flows, this minimizes losses and maximizes cash efficiency—a hallmark of autonomous payments technology.

Challenges to Agentic AI Adoption

Despite its promise, adopting agentic AI in payments isn’t plug-and-play. Institutions must overcome hurdles:

- The Regulatory Quandary

Autonomous AI decisions raise accountability and compliance concerns. AI governance in financial services must evolve, ensuring auditability and clear responsibility. Until regulations mature, organizations need strong internal governance frameworks. - The Trust Deficit

For users to accept AI-powered payment solutions, trust is crucial. Questions remain: Can AI be trusted to make financial decisions? Will users understand how? Explainable AI and transparency are essential to reduce the challenges of AI adoption in payments industry. - Technical Limitations and Investment Hesitancy

Deploying AI-driven payment automation requires high-performance computing and seamless integration. Legacy systems slow adoption, but modular pilots—steps to integrate agentic AI into financial workflows—help prove ROI. - The Scale of Payment Inefficiency

Batch processing and siloed systems prevent true real-time automation. To enable examples of AI agents in cross-border payments or reconciliation at scale, enterprises need API-first, cloud-native, digital-first infrastructure.

Use Cases on the Horizon

While early adoption is underway, several use cases highlight how agentic AI is transforming payments:

- Corporate Payment Transformation

Intelligent payment systems autonomously choose the best method (ACH, wire, card) based on speed, supplier preference, or cost. This positions finance teams to operate with hedge fund-level precision—showcasing the future of payments with AI. - Collections and Debt Recovery

AI agents personalize outreach strategies, balancing empathy with efficiency. How autonomous AI agents reduce payment fraud extends to improved collections outcomes without damaging relationships. - B2B Marketplace Enablement

From KYC/AML onboarding to embedded finance, agentic AI for financial services enables marketplaces to handle compliance and transactions seamlessly. This represents one of the most impactful AI-powered payment solutions for procurement platforms.

Making Agentic AI Work: The Adoption Playbook

The real challenge isn’t building intelligent agents, but integrating them into a fragmented ecosystem. Here’s the playbook:

- Adopt Modular, API-First Architectures for end-to-end payment automation.

- Integrate AI-powered KYC and AML tools for compliance.

- Collaborate early with regulators on AI governance in financial services.

- Enhance trust with transparency and explainable AI dashboards.

- Upskill teams in data science, compliance, and treasury to lead AI-driven payment automation.

- Run pilots like automated payment reconciliation or dynamic settlement optimization before scaling.

Prolifics: Your Innovation Partner in Agentic AI for Payments

At Prolifics, we believe The Rise of Agentic AI in Digital Payments isn’t just a fintech trend, but the future of payments with AI.

We help banks, payment providers, and fintechs strategically adopt agentic AI in payments with modular, secure, and scalable approaches:

- AI-powered digital wallets and virtual card payment security solutions

- Automated payment reconciliation with intelligent forecasting

- AI-enabled smart contracts and programmable money platforms

- AI compliance and governance in financial services

Our consultative approach ensures outcomes that are explainable, ethical, and transformative.

Conclusion: Payments, Reimagined

Agentic AI holds the potential to reinvent payments as we know them, turning every transaction into a seamless, intelligent interaction. It promises to slash inefficiencies, reduce fraud, boost customer satisfaction, and enable entirely new business models.

But the transformation requires more than algorithms, it demands trust, regulatory collaboration, talent, and vision.

At Prolifics, we bring together all four to help you build the autonomous, intelligent payment ecosystems of tomorrow, today.

Contact Prolifics to start your journey toward smarter, autonomous payment solutions.