The financial services industry stands on the edge of a once-in-a-generation shift. For decades, organizations have relied on data-driven strategies to make smarter decisions, reduce risk, and improve customer experience. Today, those same organizations are rethinking what’s possible with an AI-first approach in finance, where artificial intelligence in financial services is no longer a supporting function but the foundation of strategy, innovation, and growth.

As market volatility rises and customer expectations evolve, AI-driven finance transformation has become the key differentiator. From intelligent automation and predictive insights to Generative AI in finance, this shift is reimagining every aspect of the financial ecosystem.

Defining the AI-First Approach in Finance

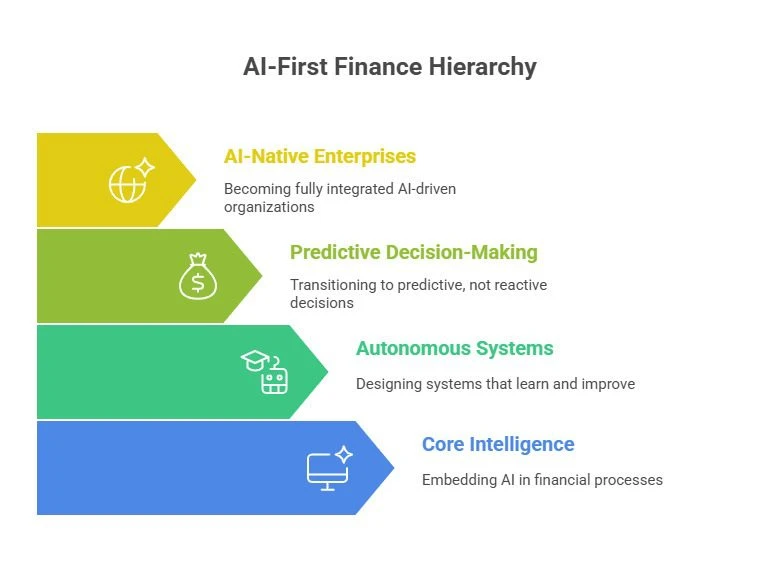

An AI-first approach in finance means embedding intelligence at the core of every financial decision, process, and interaction. It goes beyond adopting isolated AI tools; it’s about designing systems where AI and data analytics in finance drive continuous optimization, foresight, and responsiveness.

Traditional digital transformation focused on automation and efficiency. But an AI-first finance model creates systems that learn, reason, and improve autonomously. This evolution allows financial institutions to transition from being data-informed to becoming AI-native enterprises, where decision-making is predictive, not reactive.

AI Innovation in Banking and Finance

The future of finance with AI-first organizations is defined by agility, personalization, and intelligent automation. Across the financial sector, we’re witnessing AI innovation in banking and finance reshape how institutions serve their customers and manage their operations.

1. AI in Risk Management and Compliance

Risk management is no longer confined to manual checks or retrospective audits. With AI in risk management and compliance, institutions can now identify anomalies in real time, detect fraud before it happens, and ensure ongoing adherence to complex regulatory frameworks.

AI-enabled fraud detection models analyze millions of transactions per second, reducing exposure while improving trust and transparency.

2. Predictive Analytics for Banking

Predictive models are becoming central to financial forecasting and market analysis. Through predictive analytics for banking, financial leaders gain deeper insights into credit scoring, liquidity management, and investment trends.

The ability to anticipate change, not react to it, has become a core capability for leading AI transformation in the finance industry.

3. AI Automation in Banking

From intelligent document processing to customer service bots powered by Generative AI, AI automation in banking is transforming how institutions operate. Manual reconciliation, loan approvals, and onboarding processes are being reimagined through self-learning systems that deliver faster, error-free results, all while reducing operational costs.

The Technology Backbone of AI-Driven Finance Transformation

An AI-driven finance transformation relies on robust data architectures, seamless integration, and cloud scalability. The foundation begins with unified data platforms that enable AI and data analytics in finance to work together across front, middle, and back-office functions.

Modern banks and financial institutions are leveraging hybrid AI architectures that blend deterministic models with Generative AI in finance to create explainable, ethical, and scalable solutions. AI-first organizations prioritize data governance, transparency, and responsible AI, ensuring compliance while accelerating innovation.

Benefits of Adopting AI in Finance Operations

Organizations that embrace AI-first strategies are realizing significant benefits in efficiency, profitability, and resilience.

- Operational excellence: Intelligent automation eliminates redundancies, accelerates processes, and improves accuracy.

- Enhanced customer experience: AI enables hyper-personalization and real-time financial advice.

- Data-driven foresight: Predictive and prescriptive analytics empower smarter investments and risk mitigation.

- Stronger compliance posture: Automated monitoring reduces regulatory risks and enhances audit readiness.

In short, the benefits of adopting AI in finance operations extend beyond cost savings they redefine how finance teams deliver value across the enterprise.

Reimagining Finance with an AI-First Approach

The truth is that AI-first finance is already reimagining established practices. Whether it’s algorithmic trading, AI-powered portfolio management, or real-time fraud prevention, innovation is no longer theoretical; it’s operational.

Generative AI is driving a profound transformation in financial services, enabling CFOs and analysts to simulate economic scenarios, generate forecasts, and produce insights in seconds. The organizations that treat AI as a strategic asset rather than a tool are positioning themselves for long-term advantage.

The Future of Finance with AI-First Organizations

As we look ahead, the future of finance with AI-first organizations will be defined by adaptive intelligence and continuous innovation. Finance leaders will rely on AI not just to optimize processes but to shape new business models and products.

From autonomous finance systems that self-correct to GenAI copilots supporting strategic decision-making, the next evolution of AI transformation in the finance industry is already underway.

Financial institutions that act now to integrate AI across their data, governance, and decision-making frameworks will lead this new era of resilience and growth.

Conclusion: The Path to an AI-Ready Financial Future

The journey to reimagining finance with an AI-first approach is not just about adopting new technology; it’s about transforming how financial organizations think, decide, and operate. At Prolifics, we help enterprises move from exploration to execution, combining AI innovation, governance, and integration frameworks that make finance smarter, faster, and more strategic.

Our approach bridges trusted data, intelligent automation, and human expertise, empowering financial institutions to predict outcomes, optimize decisions, and create truly adaptive business models.

In this new era, finance is no longer reactive; it’s predictive, autonomous, and visionary.

The organizations ready to lead this transformation are those building toward an AI-ready future today.

Join us as we explore this transformation in depth at our event,

Unlocking the Future of Banking & Finance with Agentic AI