Artificial intelligence is reshaping financial technology. It is moving beyond basic automation. Instead of handling only repetitive tasks, AI agents in fintech help companies personalize services, improve security, and make faster, data-driven decisions.

From customer onboarding to transaction monitoring, AI agents in fintech strengthen every stage of the financial journey.

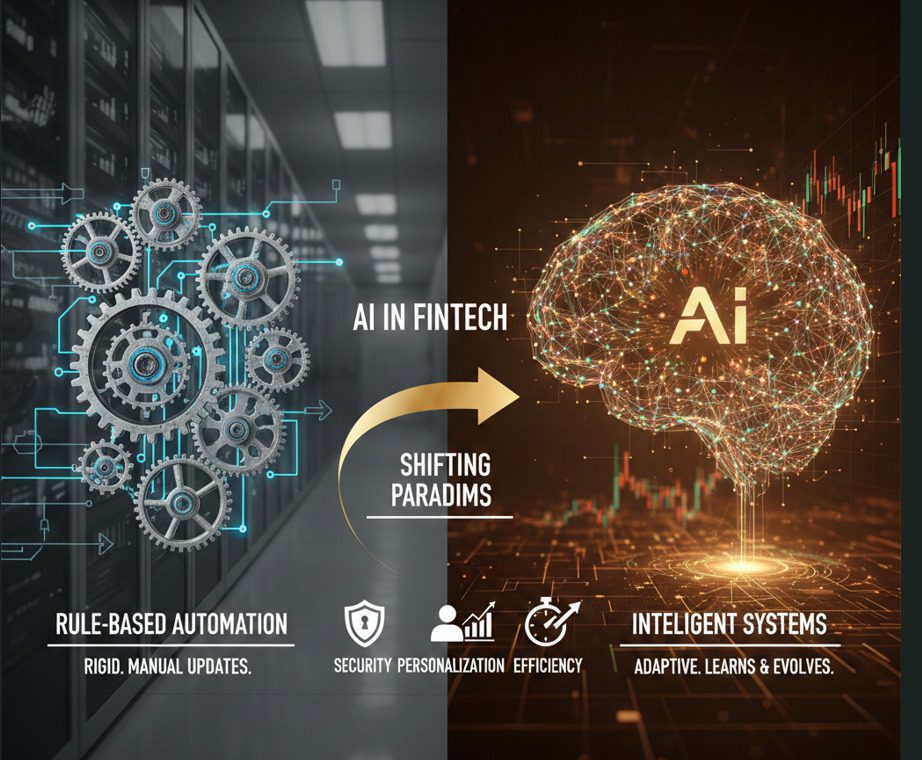

Traditional fintech systems depend on fixed rules. They need manual updates when conditions change. In contrast, modern AI platforms learn continuously from historical and live data. They detect patterns and anomalies automatically.

This shift transforms fintech from static execution to intelligent decision-making powered by real time AI decision making in fintech.

The measurable impact is clear. Many institutions have reduced fraud response times dramatically sometimes by up to 99%. AI-driven lending can now approve loans in minutes instead of days.

Beyond efficiency, AI agents in fintech create long-term strategic value. They improve risk evaluation, enable tailored advice, and support ongoing compliance monitoring. In complex markets, this intelligence becomes a competitive advantage.

Key Points

- AI enhances demand forecasting and financial modeling with deeper predictive accuracy.

- Risk assessment becomes more precise through advanced data analysis and behavioral insights.

- AI-driven fraud detection systems can flag suspicious activity instantly.

- Automated loan approvals reduce processing time from days to minutes.

- AI supports personalized banking using AI recommendations.

- Intelligent chatbots and virtual assistants improve 24/7 customer service experiences.

- Algorithmic trading systems leverage AI to analyze market trends and execute trades efficiently.

- Regulatory Compliance Automation helps firms adapt to rule changes.

- AI reduces operational costs by minimizing manual intervention and errors.

- Predictive analytics supports proactive risk management and strategic planning.

Understanding AI in Fintech

AI in fintech describes the use of intelligent technologies such as machine learning and advanced analytics to process financial data, detect patterns, and make predictive or automated decisions. Unlike traditional systems that rely on fixed rules and manual inputs, AI-driven solutions continuously learn from new information and improve their performance over time.

By processing massive volumes of structured and unstructured information, institutions enhance risk checks, streamline operations, and prevent fraud. This evolution marks the rise of agentic AI in financial services.

From Rule-Based Automation to Intelligent Systems

Although both traditional automation and AI improve operational efficiency, they function on fundamentally different principles. The distinction lies in adaptability, where automation follows instructions, AI interprets data and evolves with it.

Traditional Fintech Automation

Conventional fintech automation relies on predefined, rule-based workflows. These systems execute tasks according to programmed logic and require manual updates whenever business rules or market conditions change.

While this approach enhances speed and consistency for routine operations, it remains rigid. It cannot independently learn from new data, detect emerging patterns, or adjust its behavior without human intervention.

AI-Powered Fintech Platforms

AI-enabled fintech systems operate beyond fixed programming. They continuously analyze incoming data, identify patterns, and refine their models as new information becomes available.

Because these systems are trained to recognize trends, anomalies, and behavioral signals, they support dynamic outcomes such as real-time credit assessments, predictive risk scoring, and hyper-personalized banking services.

Key Applications of AI in Financial Technology

AI’s real value appears in three areas:

- security

- personalization

- operational speed

Together, they demonstrate the growing benefits of agentic AI for financial institutions.

Fraud Detection and Risk Management

Fraud is one of the largest threats to financial organizations. Losses reach billions each year, along with investigation and compliance expenses.

AI-driven fraud detection systems monitor activity in real time. They identify unusual behavior before damage escalates.

For example, if a customer usually shops locally but suddenly makes a large overseas purchase, AI can react immediately. Transactions may be paused, or customers alerted.

This is exactly how AI agents improve fraud detection in banks while reducing false alarms.

Personalized Financial Experiences

AI enables financial institutions to tailor products and services based on individual customer behavior, preferences, and financial history. Rather than offering standardized rates or generic products, organizations can align recommendations with each customer’s unique financial profile.

Robo-advisory platforms extend this personalization further by creating customized investment strategies based on goals and risk tolerance. As market conditions shift, AI algorithms adjust recommendations dynamically, delivering adaptive financial guidance that was once accessible only through dedicated human advisors.

Intelligent Automation Across Financial Operations

Organizations that invest in intelligent automation in fintech report strong gains.

- Efficiency can improve by up to 60%.

- Costs may fall by nearly 40%.

Routine work like data entry becomes automated. Teams then focus on strategic activities that require expertise.

Accuracy also rises. Fewer mistakes mean stronger lending, better compliance, and improved outcomes.

How AI Is Reshaping Fintech Careers and Skills

AI is transforming both financial services delivery and the skills required in fintech roles. A large share of banking tasks can now be enhanced by generative AI, driving measurable productivity improvements.

Employers now seek professionals who understand finance, analytics, and platforms that support agentic AI in financial services. Critical thinking ensures responsible deployment.

Risks, Ethics, and Responsible AI in Fintech

AI offers major benefits, but risks remain.

Potential issues include:

- biased outputs

- unclear decisions

- privacy concerns

- model inaccuracies

Strong governance, regular testing, and transparent frameworks are vital. Human judgment must always guide automated outcomes.

How Artificial Intelligence Is Redefining the Future of FinTech

AI’s influence will deepen. It will determine which firms lead and which fall behind.

One major development is the integration of AI with blockchain. Smart contracts may soon adjust terms automatically as risks evolve.

At the same time, agentic AI in financial services is moving toward full production scale.

Instead of suggesting products, systems might soon select and manage them independently. This represents the next wave of AI agents in fintech.

Advancing Fintech Transformation Through Prolifics Intelligence

As fintech evolves, organizations need scalable, enterprise-ready AI to drive real impact. Prolifics helps financial institutions modernize operations, enhance security, and accelerate innovation through advanced AI, data, and cloud solutions.

From AI-driven fraud detection systems to cloud adoption and governance, organizations can transition from pilots to measurable value. The result is better compliance, stronger performance, and superior customer experience.