IBM StreamSets makes real-time, hybrid multicloud data integration

Orlando, Florida (USA), 29 September 2025 — The scramble to feed AI and analytics with fresh, trustworthy data became easier. IBM® StreamSets now delivers smart, real-time data pipelines through an intuitive, low-code data integration studio, so teams can integrate data across hybrid and multicloud estates without stitching together brittle tools.

At the heart of the offer is a unified control plane, also available within IBM watsonx.data integration, which lets you design reusable pipelines across integration styles (batch, streaming, CDC, unstructured) and data types. The result: fewer siloed tools and less rework as technologies evolve.

Performance is built in. IBM StreamSets real-time data integration is engineered to ingest millions of records across thousands of pipelines within seconds, reducing data staleness for modern analytics and intelligent apps. Its prebuilt, drag-and-drop processors detect and adapt to data drift, insulating pipelines from upstream changes that used to break production flows.

Deploy anywhere your data lives. Run IBM StreamSets as SaaS on major hyperscalers, AWS and Azure listings are available today, and deploy engines into your own VPCs. Teams working on Google Cloud can still deploy engines in their GCP projects and VPCs (even without a marketplace listing), with documented patterns for GCE deployments.

For programmatic productivity, the StreamSets SDK for Python lets engineers template, secure, and roll out pipelines at scale—ideal for DataOps automation with StreamSets and consistent policy enforcement. The latest 6.6 release expands enterprise controls and streamlines developer workflows.

StreamSets is now fully part of IBM’s Data & AI portfolio, following IBM’s acquisition of the technology, strengthening the company’s end-to-end integration and data ingestion stack for AI-ready architectures.

Why it matters (fast)

- One pane of glass: Design, run, and govern streaming pipelines via a single control hub, no hand coding required.

- Future-proof pipelines: Automatic resilience to schema shifts and source changes minimizes firefighting.

- Open destinations: Move structured, semi-structured, and unstructured data to your lakes, warehouses, and event hubs.

- Hybrid by design: SaaS control with engines in your cloud or on-premises network for data residency and security.

High-impact use cases

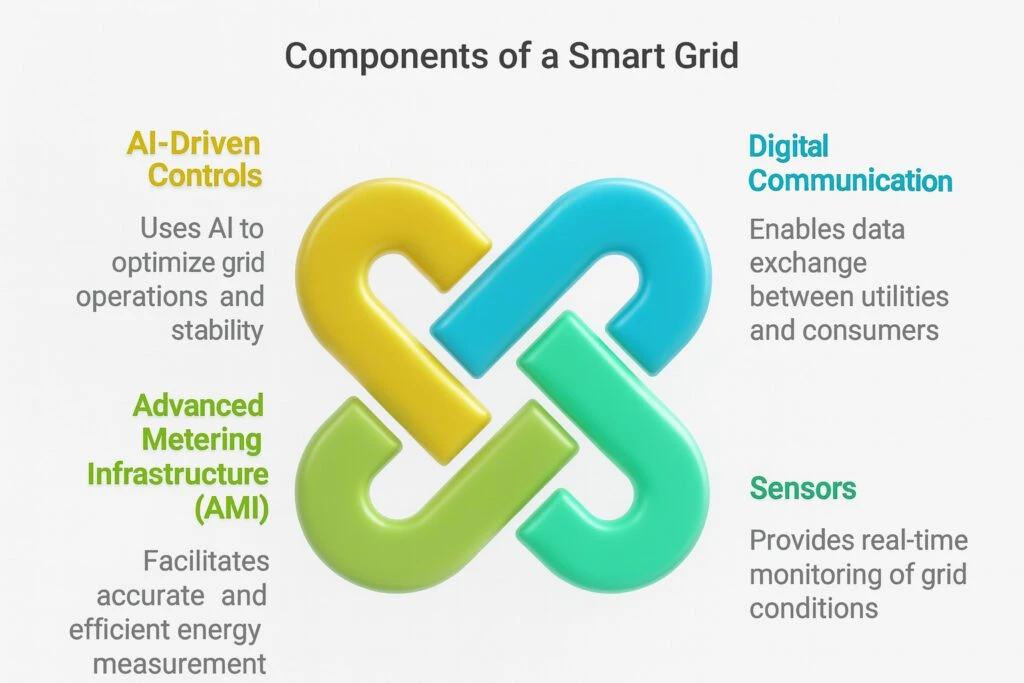

- AI & analytics in real time: Stream clickstreams, IoT telemetry, and transaction feeds into lakehouses to power instant insights and model features.

- Change Data Capture to cloud: Mirror operational databases to Azure Synapse or AWS analytics services with low latency for modernization projects.

- Data reliability at scale: Tame constant upstream change (data drift) to keep executive dashboards and AI pipelines accurate.

- Governed multicloud ingest: Deploy engines in your own VPCs on AWS, Azure, or GCP to satisfy sovereignty and compliance needs.

Ready to turn streaming chaos into a competitive advantage? Partner with Prolifics. Our architects design watsonx.data-ready pipelines, accelerate time-to-value on AWS/Azure/GCP, and operationalize DataOps with the StreamSets Python SDK, so your teams ship reliable, real-time data to every product and decision.

With our expertise in IBM StreamSets, we help enterprises modernize with hybrid multicloud data pipelines and future-proof their investments through DataOps automation with StreamSets and intuitive low-code data integration strategies.

Let’s build your first production-grade pipeline together, partner with Prolifics today.

Media Contact: Chithra Sivaramakrishnan | +1(646) 362-3877 | chithra.sivaramakrishnan@prolifics.com