API Testing in Modern Development: How to Ensure Quality & Performance

In modern software development, API testing plays an important role in ensuring applications are reliable, secure, and high-performing. As APIs form the backbone of communication between services, systems, and applications, validating their behavior before deployment is essential to delivering seamless digital experiences and strengthening API quality engineering practices.

Unlike UI testing, which focuses on the user interface, API testing targets the underlying service layer, where business logic and data exchanges occur. It ensures that endpoints behave as expected, data is transmitted accurately through API Data Contract Validation, integrations remain stable, and systems continue to perform reliably, even under heavy loads or unexpected conditions. Strong performance testing for APIs further ensures that service layers remain resilient and scalable.

Modern applications rarely operate in isolation. APIs enable:

- Communication between mobile apps and back-end services

- Integration with third-party partners, data sources, and service providers

- Real-time updates, transactions, and business logic enforcement

- Scalable microservices architectures in cloud environments supported by Microservices Integration Testing

That means APIs are responsible for critical business workflows, and failures here directly translate into customer frustration, lost revenue, and brand risk. A structured shift-left API testing approach ensures issues are caught early before they escalate into production incidents.

Yet traditional testing approaches often fall short. GUI or UX testing alone cannot uncover the kinds of defects, performance issues, or compliance gaps that lurk beneath the surface. This is why API testing shines it gets below the UI and tests the business logic, data contracts, reliability, performance, and security of the system itself. Modern API quality engineering integrates API security and compliance testing alongside functional validation to ensure complete coverage.

What Effective API Testing Looks Like in Practice

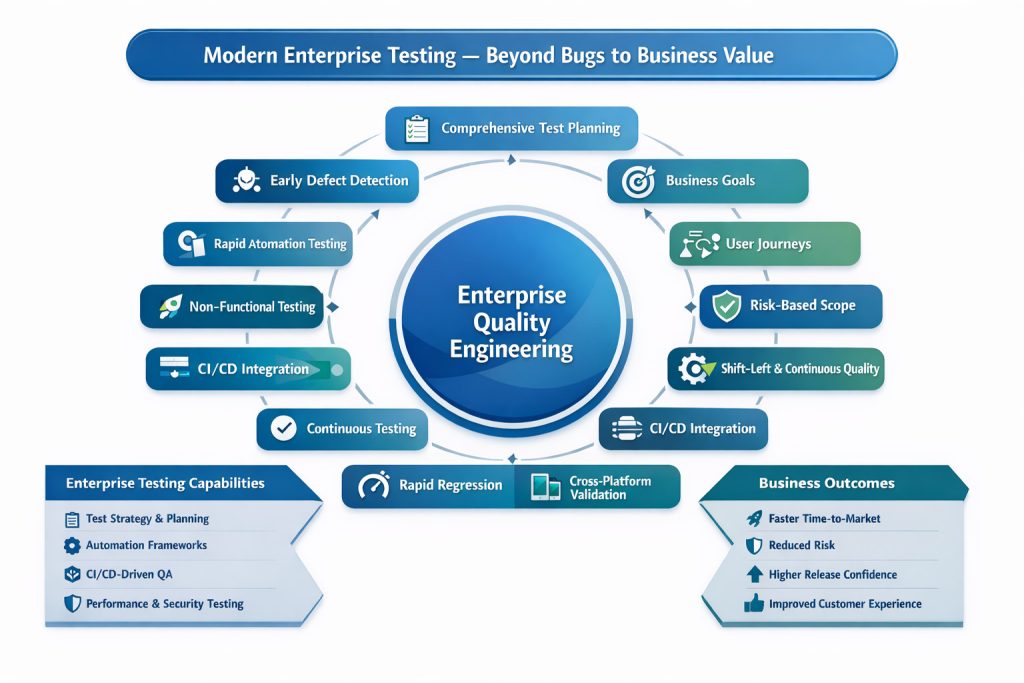

A robust API testing strategy should cover many dimensions and align with a strong shift-left testing strategy:

🔹 Functional Correctness — Does the API do what it’s supposed to?

🔹 Security & Compliance — Is access controlled? Are data protections enforced?

🔹 Performance & Load — Can it handle peak traffic volumes?

🔹 Integration & End-to-End Reliability — Do all parts of the system work together without failure?

🔹 Automation & Shift-Left Testing — Are tests integrated into CI/CD so defects are caught early?

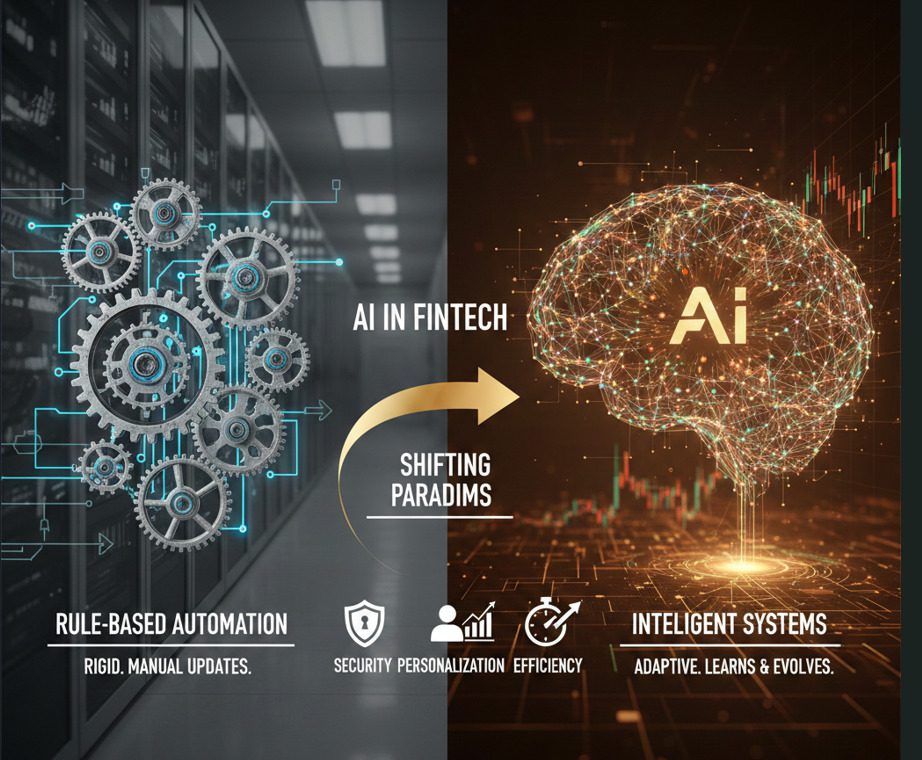

But quality isn’t just about testing; it’s about engineering quality into the process. That means embedding tests early in development cycles through Shift-Left API Testing, leveraging AI-Driven Test Automation, and analyzing test results using predictive models to prevent failures rather than simply detecting them after the fact. This is the foundation of advanced API quality engineering.

The ROI of Quality Engineering

When API testing and quality practices are done right, organizations realize measurable business outcomes and see tangible ROI of AI-powered predictive analytics in quality engineering initiatives:

- Faster Time-to-Market: Automated API tests integrated into CI/CD pipelines reduce cycle times and accelerate releases.

- Lower Development Costs: Catching defects early costs far less than fixing issues in later stages or post-release.

- Higher Customer Trust: Reliable, secure APIs reflect directly on user experience and customer satisfaction.

- Reduced Operational Risk: Performance and security testing break down failure modes before they impact production.

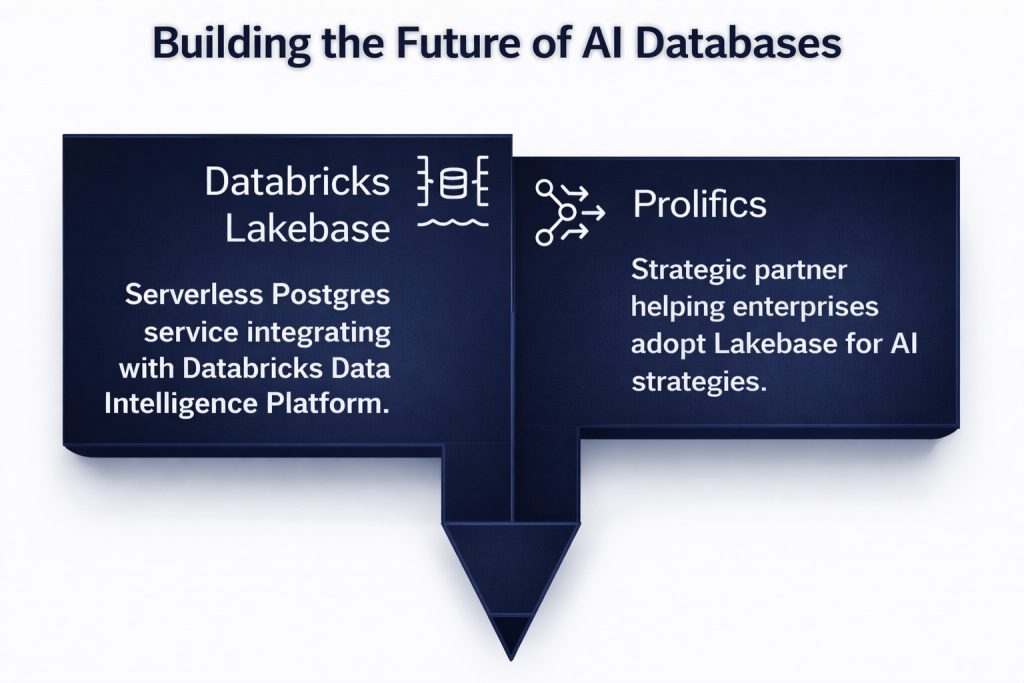

Why Prolifics Is Your Ideal Partner for API Quality & Digital Success

Here’s how Prolifics doesn’t just test but transforms how you deliver software:

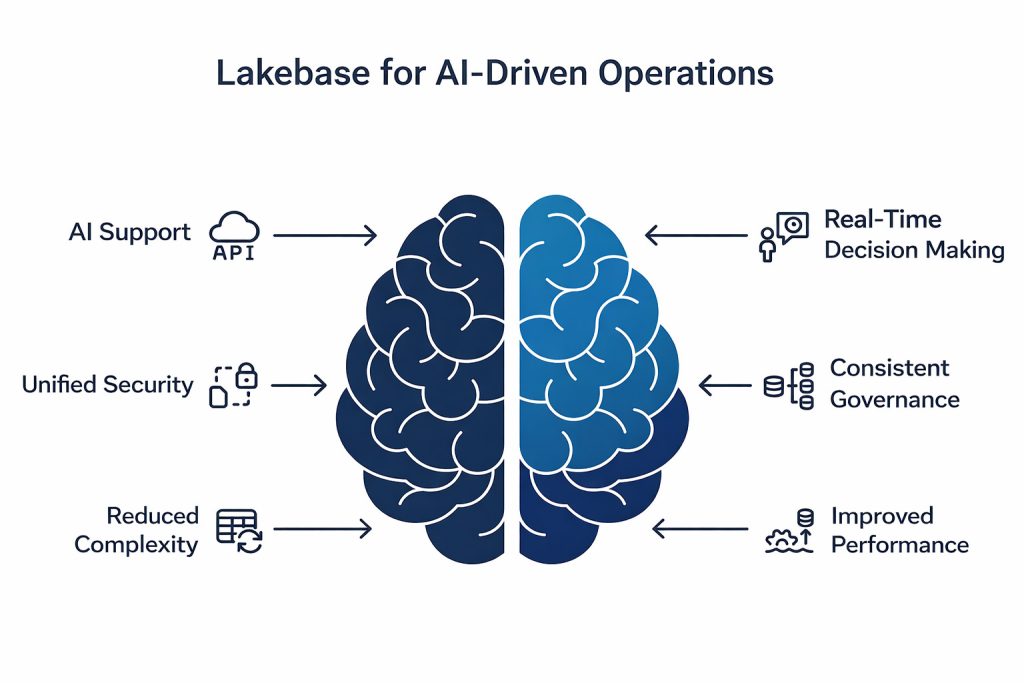

1. AI-Powered Quality Engineering & Test Automation

Prolifics delivers intelligent quality engineering, not just traditional testing. This includes:

- AI-driven predictive analytics that forecast issues before they occur

- Self-healing test automation that adapts as systems evolve

- Continuous testing integrated into CI/CD pipelines

- End-to-end assurance that improves test coverage and reduces risk

This combination accelerates delivery, lowers maintenance costs, and ensures quality is built in, not bolted on.

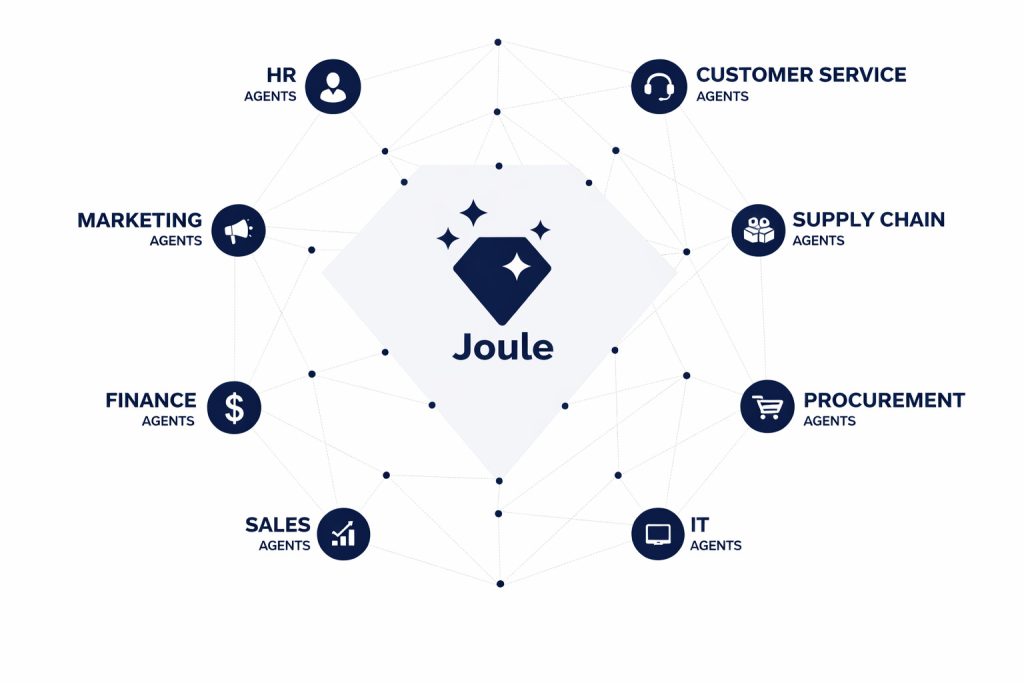

2. Deep API & Integration Testing Expertise

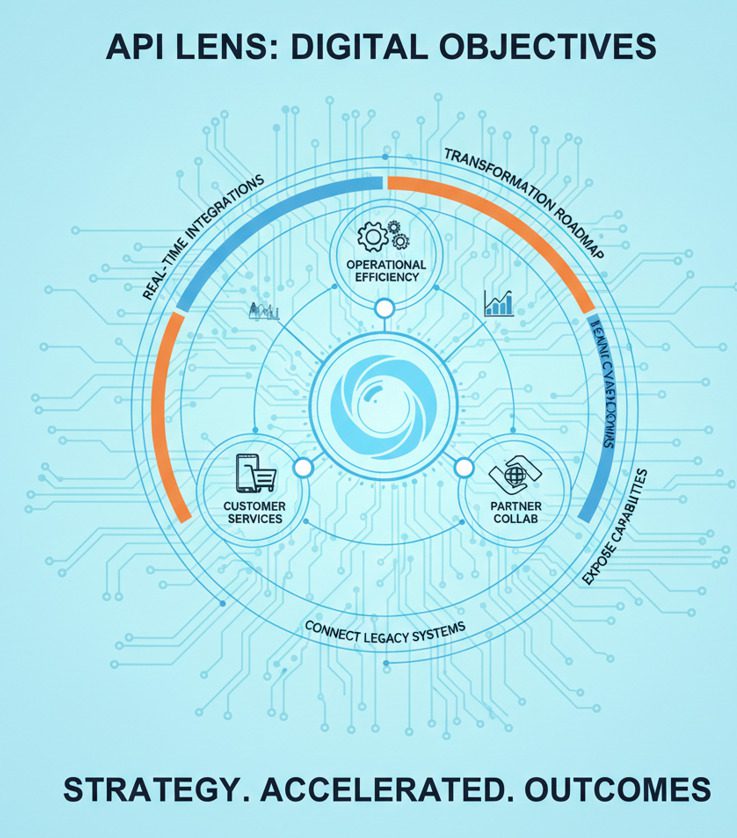

APIs don’t exist in a silo, they connect systems, partners, cloud services, and microservices. Prolifics’ Digital Integration and Platform Solutions help you:

- Streamline API-led connectivity across enterprise systems

- Eliminate legacy data silos for unified data access

- Accelerate integration testing with reusable frameworks

- Enable robust API-centric testing strategies that improve reliability

- Reduce development costs and speed delivery without compromise

This breadth ensures that regardless of environment, cloud, hybrid, or on-prem, your critical interfaces hold up under pressure.

3. Performance Engineering, Not Just Performance Testing

Many providers test performance. Prolifics goes further by offering Continuous Performance Engineering, meaning they identify root causes and propose engineering solutions, not just surface-level reporting.

This is crucial in high-stakes environments like finance, healthcare, and retail, where latency or instability can directly affect revenue, compliance, or trust.

4. Strategy + Execution + Managed Services

Prolifics doesn’t just provide tools; they offer end-to-end quality strategies, including:

- Consulting to define optimal testing approaches

- Implementation services to operationalize AI-Driven Test Automation

- Managed services that continuously monitor, optimize, and innovate

This lifecycle approach ensures sustainable API quality engineering maturity across the organization.

Real Results, Real Impact

Clients partnering with Prolifics have seen:

✔ Reduced software defects before release

✔ Automation that scales with CI/CD velocity

✔ Improved test coverage across API layers

✔ Reduced downtime and faster recovery from issues

✔ A quality engineering culture that empowers teams

In today’s digital-first world, mediocre quality isn’t acceptable; it’s expensive. Organizations that invest in comprehensive API quality engineering, backed by performance testing for APIs and AI-driven test automation, unlock faster innovation, happier users, and greater business resilience.

Conclusion

APIs are the backbone of modern software. But without rigorous testing, performance engineering, and AI-enabled quality practices, they’re also a risk vector. The difference between an API that supports your growth and one that hinders it can come down to the sophistication of your testing and quality strategy particularly your adoption of API Quality Engineering, Shift-Left API Testing, and Continuous Performance Engineering.

That’s where Prolifics steps in, transforming quality from a cost center into a competitive edge. From strategy and automation to performance engineering and managed services, Prolifics gives you the tools, expertise, and partnerships you need to win in today’s digital age.

Partner with Prolifics to elevate quality, accelerate digital transformation, and unlock superior business outcomes.