Databricks DQX: Building Trusted Data Foundations for Analytics and AI

Why modern enterprises are turning to Data Quality eXtended (DQX) frameworks, and how Prolifics helps make them real.

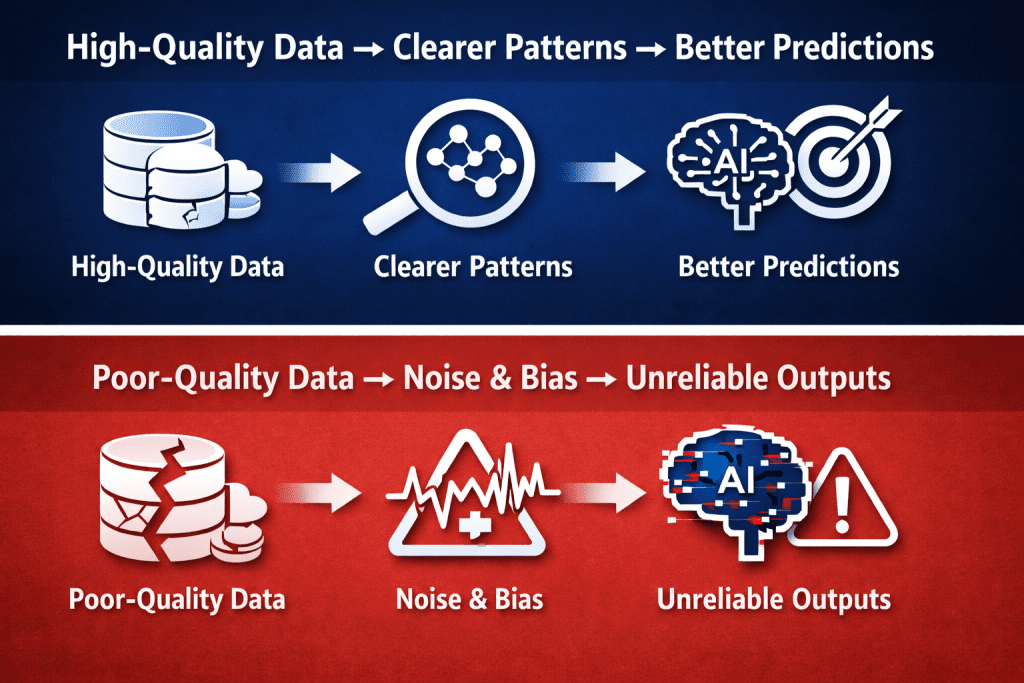

Databricks data quality framework is essential for today’s data-driven enterprises, where analytics and AI initiatives are only as strong as the data that powers them. Inconsistent, incomplete, or inaccurate data can derail dashboards, undermine machine learning models, and erode trust across the business. As organizations scale cloud data platforms like Databricks, the need for automated, repeatable, and extensible data quality controls becomes mission-critical.

Addressing this challenge head-on, Databricks introduced DQX (Data Quality eXtended), a modern data quality framework designed to embed quality checks directly into data pipelines. As highlighted in Hexaware’s recent blog, DQX provides a scalable and unified approach to managing data quality across batch and streaming workloads, aligning seamlessly with the Lakehouse architecture.

What Is Databricks DQX?

Databricks DQX is an extensible data quality framework that enables data teams to profile, validate, and monitor data continuously as it moves through the pipeline. Rather than treating data quality as a downstream or manual process, DQX integrates quality rules and controls directly into ingestion, transformation, and consumption layers.

This approach ensures that data issues are detected early, handled consistently, and governed transparently supporting both operational analytics and AI-ready datasets.

How the DQX Framework Works

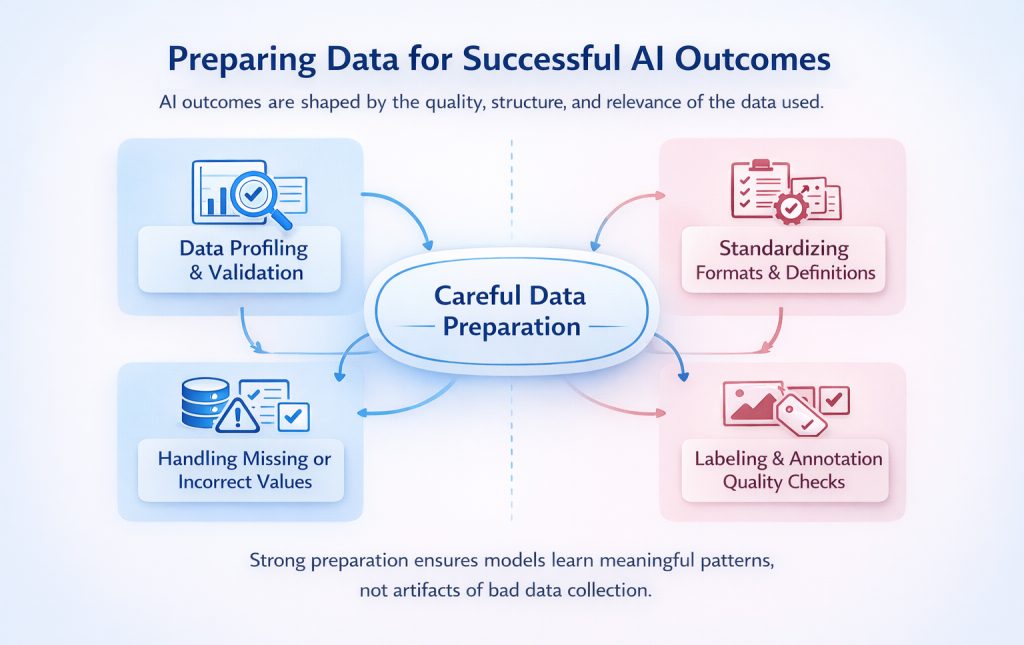

DQX spans the full lifecycle of data pipelines, focusing on three core stages:

- Data Profiling

DQX helps teams understand their data by automatically analyzing distributions, patterns, null values, and anomalies. Profiling provides a baseline for defining meaningful data quality rules. - Data Validation

Using rule-based checks, DQX enforces expectations such as schema conformity, range checks, uniqueness, and completeness. These rules can be applied consistently across batch and streaming pipelines. - Data Monitoring

DQX continuously monitors data quality metrics over time, making it easier to detect drifts, recurring issues, or SLA breaches before they impact downstream consumers.

Key Capabilities of Databricks DQX

The DQX framework stands out for its flexibility and enterprise readiness:

- Support for both batch and real-time streaming pipelines

- Rule enforcement with configurable thresholds and expectations

- Reaction strategies, such as quarantining bad records, logging failures, or stopping pipelines

- Native alignment with Databricks Lakehouse, Delta tables, and Spark-based processing

- Extensibility to meet domain-specific and regulatory data quality requirements

Business Value: From Data Trust to Better AI Outcomes

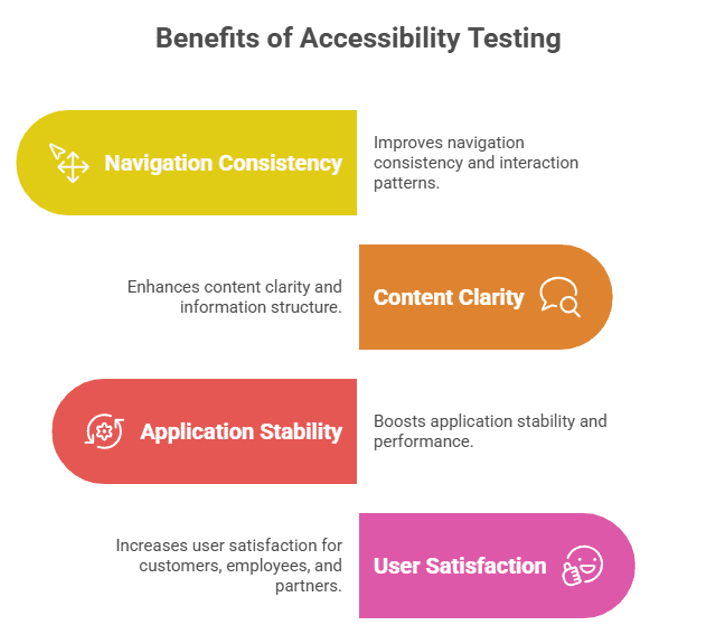

By embedding data quality into pipelines, organizations gain measurable business benefits:

- Increased trust in analytics and dashboards

- Reduced operational risk and rework caused by poor data

- Faster root-cause analysis of data issues

- Stronger foundations for AI, ML, and advanced analytics, where data quality directly impacts model accuracy

As one Prolifics data leader puts it:

“Data quality isn’t a checkpoint, it’s a capability. Frameworks like DQX allow our clients to operationalize trust at scale, not just detect problems after the fact.”

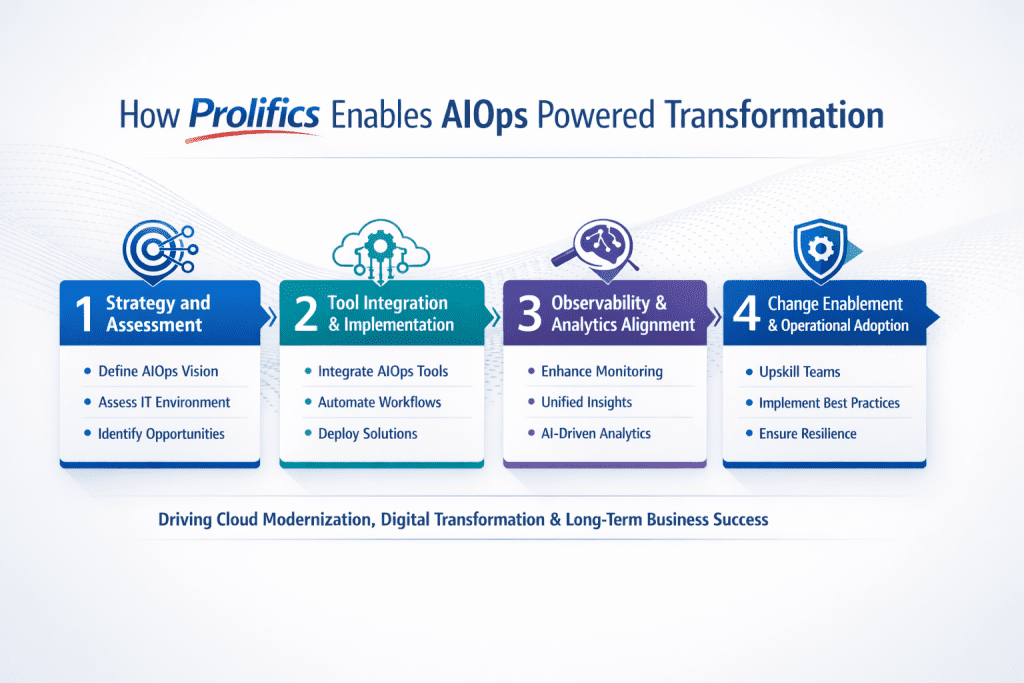

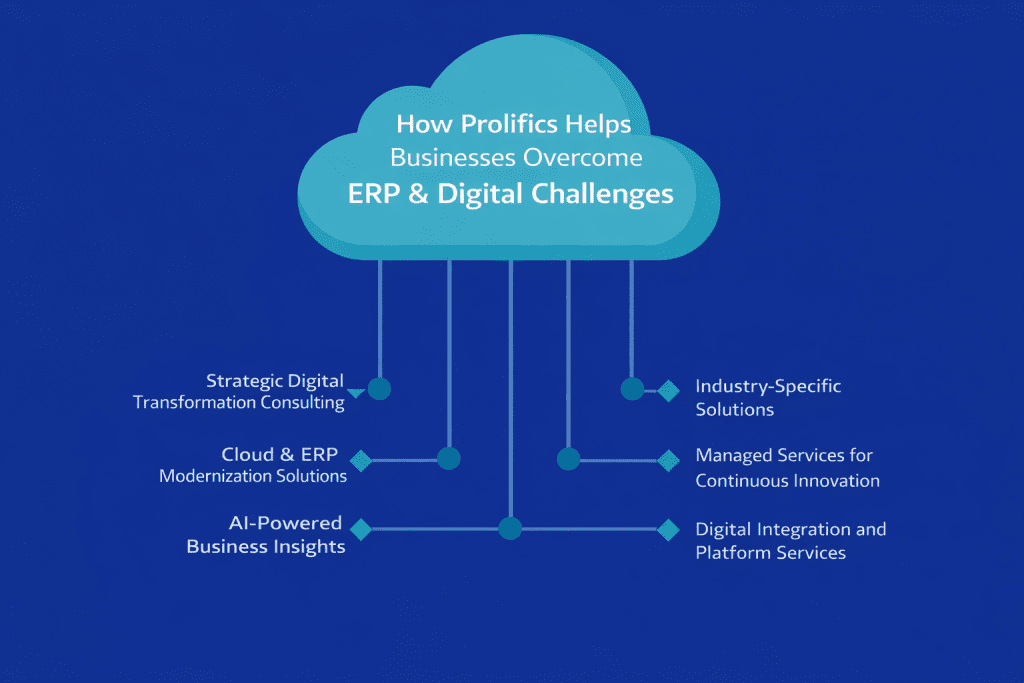

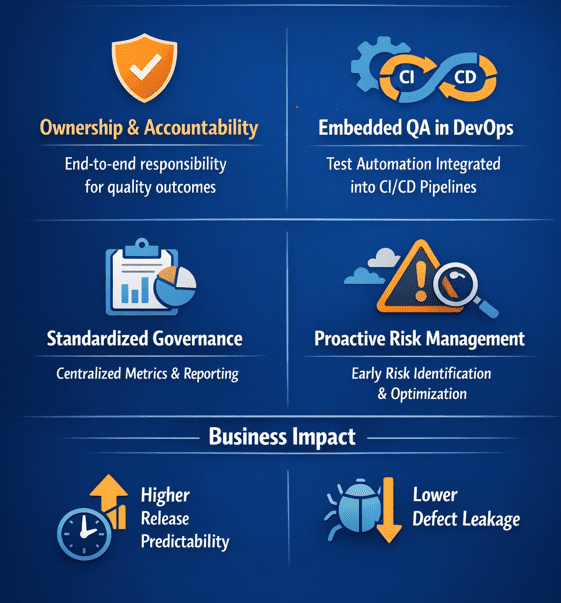

How Prolifics Enables DQX at Enterprise Scale

Prolifics helps organizations design, implement, and operationalize Databricks DQX as part of broader data modernization, analytics, and AI initiatives. From defining data quality strategies and governance models to embedding DQX into CI/CD-enabled pipelines, Prolifics ensures data quality becomes a sustainable capability, not a one-time fix.

By integrating DQX with enterprise data platforms, governance frameworks, and AI use cases, Prolifics enables clients to move confidently from raw data to trusted insights.

Unlocking Trusted Data for Analytics and AI

As enterprises invest heavily in analytics and AI, frameworks like Databricks DQX are becoming essential building blocks. With the right implementation partner, data quality transforms from a persistent challenge into a strategic advantage.

At Prolifics, we help clients unlock the full value of their data by ensuring it is trusted, governed, and ready for analytics and AI, at scale.

Media Contact: Chithra Sivaramakrishnan | +1(646) 362-3877 | chithra.sivaramakrishnan@prolifics.com